Reaction

Paper #3

Japan: S&T Strength and weaknesses in the 21st

century (Ed Lincoln, NYU)

Perspective

on technology innovation: Korean experience (Yongrak Choi, KORP)

Anticarcinogenic

function of selenium (An-Sik Chung, KAIST)

April

24, 2008

Identical

Twin or Fraternal Twin?

(Comparative study of National Innovation

Strategy of Japan, S. Korea, Taiwan

and Singapore)

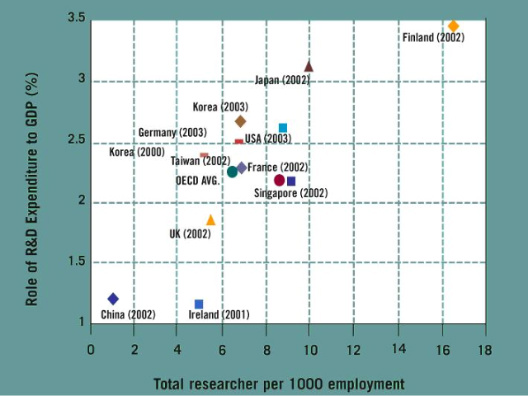

National innovation systems (NIS) of Asian countries have many similarities.

Wong (1999) described the similarities of these countries that 1) political stability during their economic developing stage, 2) prudent macroeconomic

policies, 3) export-orientation industrial policy, 4) public policies leading

to high savings rate and 5) heavy investment in human resource development. Especially,

these countries’ high R&D expenditure rate and strong human capital in

science & technology fields are taking a top position in the world as shown

in the figure 1.

Figure 1

Comparison of R&D among OECD countries

Source: World Bank (http://www1.worldbank.org/devoutreach/january07/article.asp?id=395)

However, are there any differences

among these countries’ NIS?

How can we categorize them in groups based on their similarities and

differences?

According

to Wong (1999)’s analyses of Japan

and newly industrialized economy (NIE) countries in Asia,

two main stream of technological capability development routes are implemented

in these countries: 1) reverse product life cycle and 2) reverse value chain

(refer to table 1).

Table 1 Comparison of National Innovation

Strategy of Japan

and NIE

|

|

Japan

|

Korea

|

Taiwan

|

Singapore

|

|

Period of rapid growth

|

1980s

|

1990s

|

1990s

|

1990s

|

|

NIS model

|

Large Firm Vertical Integration Model

|

Large Firm

Internalization

Model

|

SME-PRI Innovation

Network

Model

|

DFI-Leveraging Model

|

|

Technology Catch-up strategy

|

Reverse Product Life

Cycle (1960s~70s)

|

Reverse Product Life

Cycle (1980s~90s)

|

Reverse Value Chain Strategy, followed by Process Specialist

|

Process Specialist

Strategy, followed by Reverse Value Chain Strategy on a

smaller scale

|

Identical Twin (Japan and Korea: reverse product life cycle)

The

reverse product life cycle strategy for national innovation system is focusing

on developing technology capability of “supplying new end products” by

cultivating human capital of applied science and engineering. For example, Japan and Korea have focused on developing

engineering capability than basic science capability for innovation (Lincoln

& Choi’s lecture, 2008), in consequence, they have very similar industrial

structure. Vertically integrated industrial structure and national champion

strategy were practiced to develop new “competitive products” which are

marketable in developed countries. The advantages of this industrial structure

are reducing transaction cost and prevent unnecessary competition in domestic

market and focusing on international market. By protecting their domestic

market with high tariff and trade barriers, Japanese and Korean national champions

(e.g. Chaebol) were guaranteed their monopoly or oligopoly benefit in their

domestic market for their ‘end products’ and based on this sustainable and high

benefits, they have focused on cultivating their technical competencies for

developing new products for international market. For example, electronic

industry was cultivated in this ways. During 1970’s Japanese electronic

companies (e.g. Matushida, Sharp, Toshiba) shared exclusive benefits in

domestic market with transistor radio, tape recorder, color TV, and white home

appliances. Based on accumulated capital in domestic market, these national

champions collaborated with government to develop a new generation end-product:

Memory and high-tech electronic devices. Japanese government took an important

role to develop new generation technology by providing exclusive patent policy

for global competitor and moderating knowledge transferring to domestic

players. Then, Japanese electronic corporations developed new generation of

memory and they started selling this new ‘end-product’ to global market with

great success.

On

the other hand, Korea

also practiced very similar innovation strategy during 1980’s and early 1990’s

in electronic industry. Samsung, Goldstar (currently LG), Daewoo, and Hyundai

took over electronic technology from governmental research centers (e.g. ETRI)

and started their laboratory level research. However, by collaborating with

Japanese companies and Korean government supports, these Korean chaebols

concentrated implementing “new generation of production line.” Due to the lacks

of technological capability for developing end products, Korean companies

invested to new production line to catch up with the production technology

based on their “reverse product life cycle” strategy. Instead of developing

whole product life cycle, they focused on the “production” itself since they

have cheap and skilled engineers and labor workers. Similar to the Japanese

case, or somewhat more actively, Korean government also helped national

champions to cultivate their technology competences for developing new

end-products. For instance, during the economic crisis on 1998, Korean

government forced to merging and restructuring electronic industry. LG &

Hyundai merged and became Hynix and Samsung should move their automotive plants

to keep memory plants, and Daewoo electronics were sold out to foreign

investors. From these chaotic restructuring processes, Korean government built

up two major memory producers (Samsung & Hynix), LCD producers (Samsung

& LG-Philips), Mobile producers (Samsung

& LG), and Telecommunication companies (SK & KT). Consequently, these

newly dressed up national champions developed their own products by utilizing

their production line technology and merged into global market.

Fraternal Twin (Taiwan and Singapore: reverse value chain)

Compared

with large vertically integrated industry development with reverse product life

cycle strategy of Japan and Korea, Taiwan

and Singapore

have developed their innovation capability by focusing on reverse value chain

strategy.

Wong

(1998) described Taiwan

industrialization process as evolving OEM, ODM, OBM and OIM which can explain

the effort of developing reverse value chain strategy and innovation capability

for developing it. .

It is by now

well known that Taiwanese firms were among the first and largest OEM

subcontractors to many firms from the advanced countries in a wide range of

industries, ranging from bicycle assembly to electronics and computer assembly.

Over time, Taiwanese OEM firms had also made significant progress into ODM

activities, particularly in the PC-related industries. An increasing number of

Taiwanese ODM firms had also gone on to become OBMs, good examples being ACER

in PCs, and Giant in bicycles. It is indeed fair to say that it is the

Taiwanese that have invented the ODM and OBM concept, and more recently, the

concept of OIM as well. A significant number of Taiwanese firms have also

pursued the Process Specialist route.

Nowadays, this reverse value chain strategy is

widely adopted in China.

China

is a world largest OEM, ODM provider and the effectiveness of the strategy is

proven. The advantages of this strategy are 1) developing innovation capability

in a short time, 2) hedging risks of developing end products (e.g. sales &

marketing) and 3) less initial investment for innovation.

In Singapore, the

reverse value chain strategy is more directly controlled by government. Singapore government encouraged

Multi-national-companies (MNC) to install their manufacturing line in Singapore than

get OEM or OEM product itself. The encouragement of subcontract with MNC is to develop Process Specialists among local firms.

Challenges of Identical

Twin and Fraternal Twin

In

a vertically integrated national champion system, the most challenging thing

for developing innovation capability is limitation of cultivating innovative

human capital. As Dr. Choi pointed out during the lecture, Korean government

and Chaebols almost monopolize the valuable resources and human capital for

innovation. New technology entrepreneurs frequently encounter a lot of

regulations which are not favor to them. For example, the Keiretzu system

deters the free competition in high technology products in domestic market.

Many small and medium sized MP3 player manufacturers had to abandon their

business for dumping practice of national champion’s keiretzu company, and they

had to turn their eyes to global market where they don’t have strong

specialization. In addition, many valuable technology researchers and engineers

don’t want to go SME or start their own business for the unfairness of domestic

market. Eventually, this national champion and keiretzu supply chain strategy

is harmful to leap up the innovation capability of the country. This can be

proved by the small number of enterprising activities in research institute or

universities in Japan and Korea. Even

though they spend a lot of money to develop and drive enterprising activities,

the innovation activities in research and high tech engineering field would not

be increased, if the industrial structure would not be flattened and the rules

of competition would not be fair in domestic market.

The

biggest challenge for reverse value chain strategy is hard to get “economy of

scale” advantage. The practice of OEM/ODM/OBM/OIM means highly dependent on

large MNCs. The specialized value chain means ‘fragmentation’ of industrial

structure. In this situation, it is not easy to consolidate the resources for

innovation. In an under-structured industry, human capital development for large

scale innovation is not easy to achieve for its limitation of resources.

Time to balance

Reverse

product life cycle and reverse value chain strategy for innovation have their

own strengths and weaknesses. However, those systems have common pitfall in

developing human capital for sustainable innovation. In product life cycle

strategy practicing countries like Japan

and Korea, vertically

integrated and oligopoly industrial structure prohibits the creative activities

of potential innovators, meanwhile reverse value chain strategy practicing

countries (Taiwan and Singapore)

have limitation of resource allocation for innovators.

Recently,

these identical twin and fraternal twin is evolving into integration innovation

strategy. Japan & Korea is

investing a lot to developing new frontier technology as well as they promote

fair competition in their domestic market and global market. Taiwan and Singapore is trying to develop

their own technological capability by adopting many foreign educated human

resources. Then, we can say that it’s time to balancing their national

innovation system to leap up again as a global innovator.

A

healthy forest is composed with diverse plants. Big trees (national champions),

small and medium size plants (SMEs) and grasses (Entrepreneurs) are altogether

making a healthy forest. Even though Japan and Asian NIE countries

strategy were different, their objective is only one: Developing their country

as holistically healthy one as a healthy forest.

Through

the CAS 587 classes and lectures, I have learned that innovation is very hard

and tough one but it deserve to study and practice to develop a country.

Although there are lots of different strategies with according to different

resource limitation in each different countries, their objective of practicing

innovation is only one that developing a country, an organization or a person

as a holistically healthy one, then we have to continue learning from others to

develop and keep our healthy economy.

References

Wong, P.K., 1999. National

Innovation Systems for Rapid Technological Catch-up: An analytical framework

and a comparative analysis of Korea,

Taiwan and Singapore, Centre for Management of Innovation & Technopreneurship, National University

of Singapore

댓글